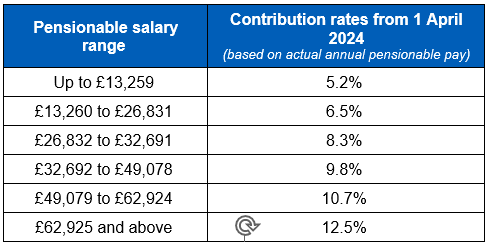

NHS Pension Scheme 2024/25 Tier Rates

NHS Pension Scheme members are reminded that contribution tier rates changed from 1 April 2024.

The table below shows the contribution rates for each salary range that are applicable in 2024/25.

Please see the NHS Pensions website for further information.

Employer contributions

The employer contribution rate from 1 April 2024 is 23.7 per cent of pensionable pay. This is an increase from the previous rate of 20.6 per cent, in place for the period 1 April 2019 to 31 March 2024. You can read more about the employer contribution rate on our web page.